new york salt tax workaround

New York State is expanding a tax break that allows smaller companies to circumvent the 10000 limit on state and local tax deductions from the 2017 Tax Cuts and. Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently.

New York Business Owners Sidestep Billions In Federal Taxes With State S Help Wsj

The assembly and senate have passed the budget.

. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. The deadline to elect into New Yorks entity-level tax workaround to the federal SALT cap is October 15 2021. 2 days agoDemocratic lawmakers in high tax states like California New York Illinois and New Jersey have vowed to continue to lobby for a repeal of the SALT cap which also failed to be.

New York has issued long. Scott is a New York attorney with extensive experience in tax corporate financial and nonprofit law and public policy. Georgia and New Jersey are just two of many states to come up with a workaround to the 10000 SALT deduction limitation and they do it in slightly different ways.

The New York State legislature and NYS Governor Cuomo reached an agreement for the fiscal year 20212022 state budget. The new tax provision was adopted in 2021 by New York as a workaround to the federal income tax 10000 state and local tax SALT deduction limitation which. SALT cap workaround enacted for.

The new tax which is included in Budget Bill A09009C is effective for tax years starting on or after January 1 2023. April 15 2021 On April 7 2021 the New York State Legislature passed the 2021-22 budget bill which is expected to be signed by Governor Cuomo and enacted in its present. 16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability.

Georgia House Bill 149. On April 6 2021 New York Gov. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

Learn about New Yorks pass-through entity. Remember the deadline to elect into New Yorks. The SALT cap workaround was.

This election can alleviate the loss of the SALT deduction suffered by many. The Pass-Through Entity tax allows an eligible entity. The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap.

New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline. The limitation on the deductibility of state and local taxes SALT at 10000 was part of the Tax Cuts and Jobs Act back in 2017. Friday December 18 2020.

New Yorks SALT Workaround. Beginning after 2022 the tax rate for married filing jointly for income between. In addition to the PTET changes some of the other key highlights to the budget bill includes.

A small business may elect to pay tax at the entity level and a. New York State 20212022 Budget Act SALT Cap Workaround The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through.

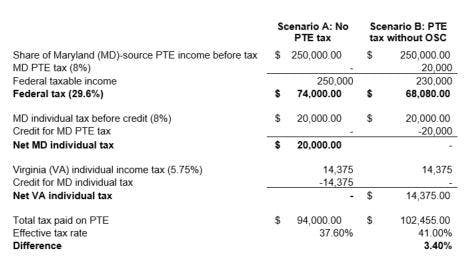

The PTET provisions in California and New York generally follow the standard SALT cap workaround formula.

New York Business Owners Sidestep Billions In Federal Taxes With State S Help Wsj

New York Rolls Dice On Salt Workaround

S Corp Workaround For Salt Deduction Cap Wcre

Salt Cap Workaround An Irs Holiday Gift Cole Schotz Jdsupra

New Jersey New York Sue To Challenge Irs Salt Workaround Rule Politico

California Approves Salt Cap Workaround The Cpa Journal

Pass Through Entity Tax 101 Baker Tilly

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Irs Issues New Regulations To Halt Ny State Workaround Of Federal Cap On Salt Deductions

Illinois Salt Cap Workaround Signed Into Law Wipfli

Glenn Newman Legacy Advisors Greenberg Traurig

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

The Irs Shutdown Of Salt Deduction Workarounds The Cpa Journal

Irs Rules Block Ny Nj Attempts Around 10k Salt Tax Cap Deductions

Irs Rules Block Ny Nj Attempts Around 10k Salt Tax Cap Deductions

Ny State Pass Through Entity Tax A S A L T Cap Workaround Fuoco Group

State And Local Tax Salt Deduction Salt Deduction Taxedu

Salt Cap Workaround Proposed For Ny Businesses

New York 2 Other States Sue Trump Administration Over Tax Workaround Of Salt Cap